世界银行《全球经济展望》2022年1月

世界银行《全球经济展望》2022年1月

After rebounding to an estimated 5.5 percent in 2021, global growth is expected to decelerate markedly in 2022—to 4.1 percent, reflecting continued COVID-19 flare-ups, diminished fiscal support, and lingering supply bottlenecks.

Although output and investment in advanced economies are projected to return to pre-pandemic trends next year, they will remain below in emerging market and developing economies (EMDEs), owing to lower vaccination rates, tighter fiscal and monetary policies, and more persistent scarring from the pandemic.

Various downside risks cloud the outlook, including simultaneous Omicron-driven economic disruptions, further supply bottlenecks, a de-anchoring of inflation expectations, financial stress, climate-related disasters, and a weakening of long-term growth drivers. Because EMDEs have limited policy space to provide additional support if needed, these downside risks heighten the possibility of a hard landing.

This underscores the importance of strengthening global cooperation to foster rapid and equitable vaccine distribution, calibrate health and economic policies, enhance debt sustainability in the poorest countries, and tackle the mounting costs of climate change.

1. Global growth is projected to decelerate in 2022 and 2023

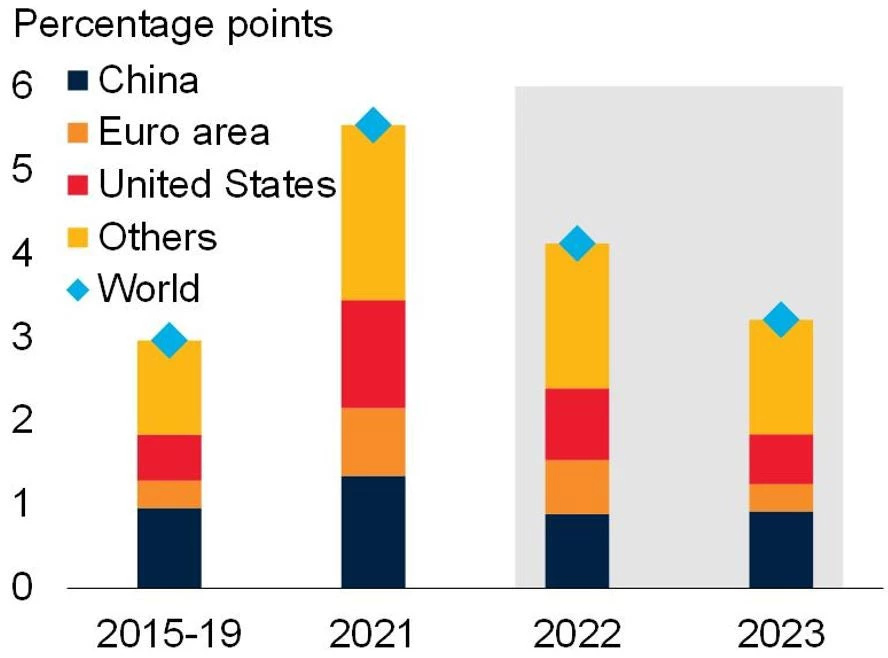

Contributions of major economies to global growth

Note: Figure shows the contribution to global growth forecasts over 2021-23, while the first bar shows the average contribution to growth in the 2015-19 period. Aggregates are calculated using real U.S. dollar GDP weights at average 2010-19 prices and market exchange rates. Shaded area indicates forecasts.

Global growth is set to slow sharply, as the initial rebound in consumption and investment fades and macroeconomic support is withdrawn. Much of the global slowdown over the forecast horizon is accounted for by major economies, which will also weigh on demand in emerging market and developing economies (EMDEs).

2. EMDEs are projected to experience a weaker recovery than advanced economies

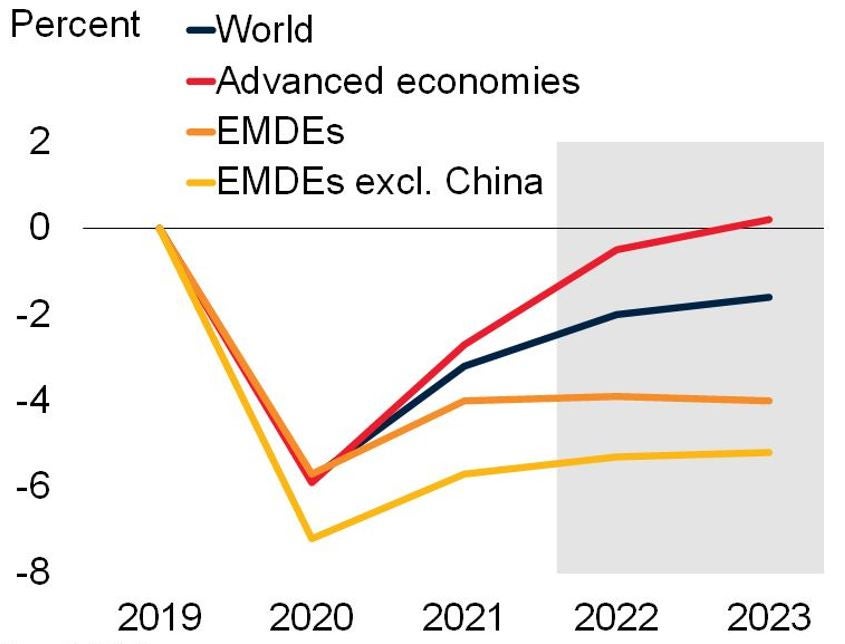

Deviation of output from pre-pandemic trends

Note: EMDEs = emerging market and developing economies. Figure shows the percent deviation between the latest projections and forecasts released in the January 2020 edition of the Global Economic Prospects report. For 2023, the January 2020 baseline is extended using projected growth for 2022. Aggregates are calculated using real U.S. dollar GDP weights at average 2010-19 prices and market exchange rates. Shaded area indicates forecasts.

In contrast to advanced economies, most EMDEs are expected to suffer substantial scarring to output from the pandemic, with growth trajectories not strong enough to return investment or output to pre-pandemic trends over the forecast horizon of 2022-23.

3. After surprising to the upside in 2021, global inflation is expected to remain elevated this year

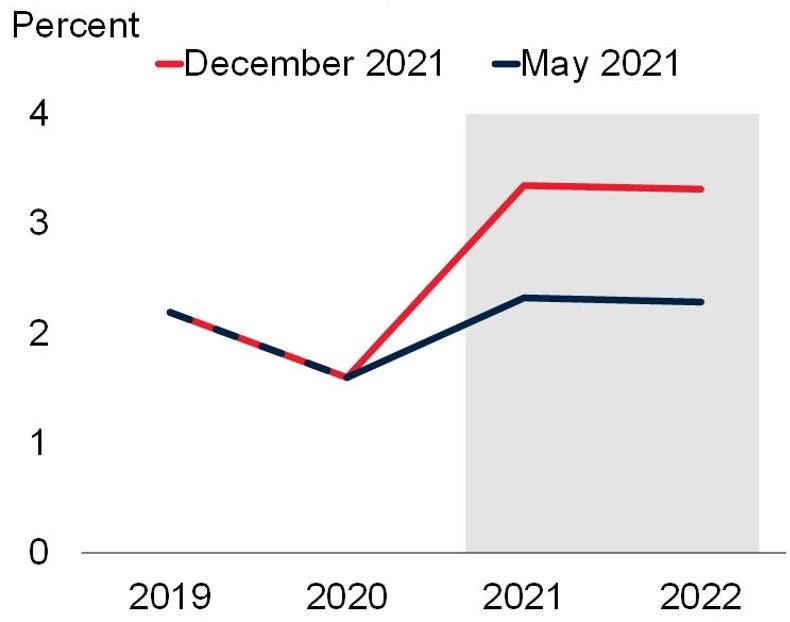

Consensus median inflation forecasts

Note: Figure shows the Consensus forecast for median headline CPI inflation for 2021-22 based on December 2021 and May 2021 surveys of 32 advanced economies and 50 EMDEs. Shaded area indicates forecasts.

The rebound in global activity, together with supply disruptions and higher food and energy prices, have pushed up headline inflation across many countries. More than half of inflation-targeting EMDEs experienced above-target inflation in 2021, prompting central banks to increase policy rates. Consensus forecasts anticipate median global inflation to remain elevated in 2022.

4. Severe economic disruptions driven by the rapid and simultaneous spreading of the Omicron variant are a key downside risk to near-term growth

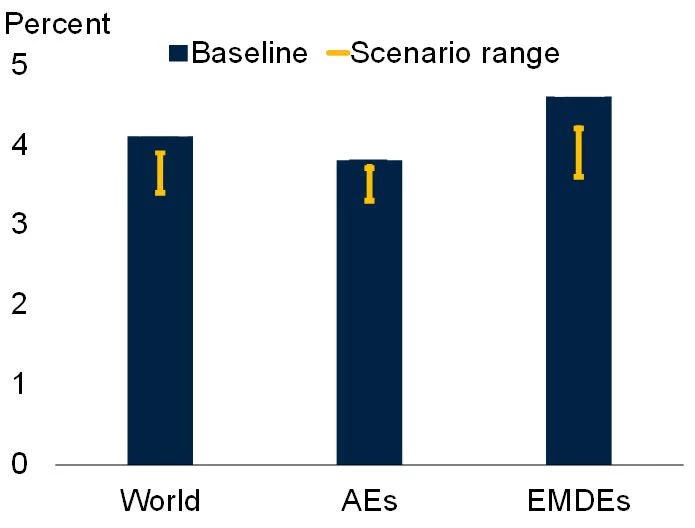

Possible Omicron-driven growth outcomes for 2022

Note: AEs = advanced economies; EMDEs = emerging market and developing economies. Yellow lines denote the range of the downside scenario in which economies (18 advanced economies and 22 EMDEs) face a range of unanticipated pandemic shocks, scaled from about one tenth to about two-tenths of the size of those from the first half of 2020.

The slowdown in global growth from 2021 to 2022 could be sharper if the fast spread of Omicron overwhelms health systems and prompts a re-imposition of strict pandemic control measures in major economies. Omicron-driven economic disruptions could reduce global growth further this year—anywhere from 0.2 to 0.7 percentage point, depending on underlying assumptions The associated dislocations could also aggravate supply bottlenecks and exacerbate inflationary pressures.

5. Global cooperation and effective national policies will be needed to address the severe costs associated with weather and climate disasters

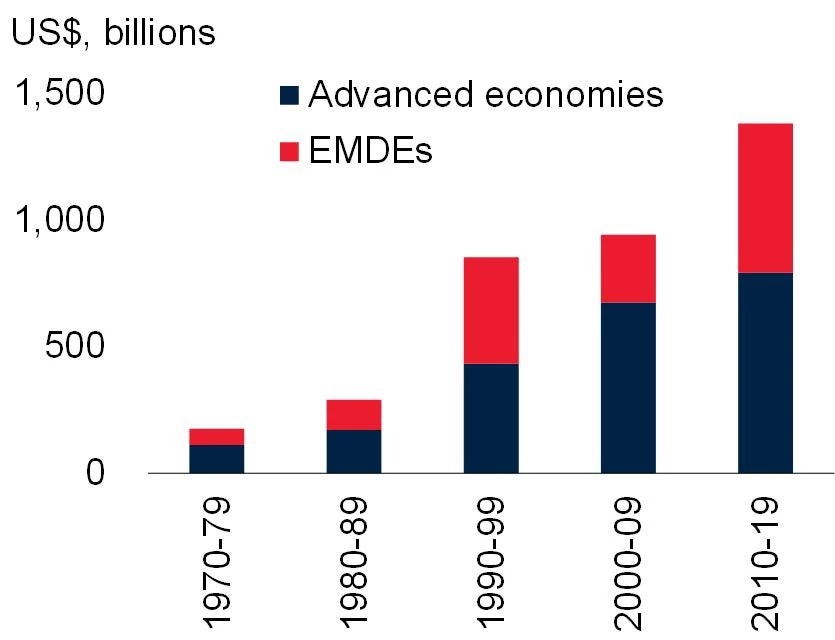

Economic losses from weather and climate disasters

Note: EMDEs = emerging market and developing economies. Figure shows the sum of all damages and economic losses directly or indirectly related to weather, climate, and water-related hazards. Hazards are associated with natural, geophysical, meteorological, climatological, hydrological, and biological events.

Severe natural disasters and climate-related events could also derail the recovery in EMDEs. Global cooperation is needed to accelerate progress toward meeting the goals of the Paris Agreement on Climate Change, and to reduce the economic, health, and social costs of climate change, many of which are born disproportionately by vulnerable populations.

The international community can also help by scaling up climate change adaptation, increasing green investments, and facilitating a green energy transition in many EMDEs. National policy actions can also be tailored to promote investments in renewable energy and infrastructure and to foster technological development. In addition, policy makers can prioritize growth-enhancing reforms that increase preparedness for future climate-related crises.

Join the Conversation